As Montana grapples with a state budget crisis, lawmakers and the public are asking questions about a sales tax and debating whether to consider enacting a statewide sales tax in Montana. Montana is one of only a handful of states that does not impose a statewide sales tax. States without a sales tax include Alaska, Delaware, New Hampshire, Montana, and Oregon.[1] This brief will outline a number of concerns with enacting a sales tax in Montana.

Montana’s Tax System Is Fairer Than Most States but Still Regressive

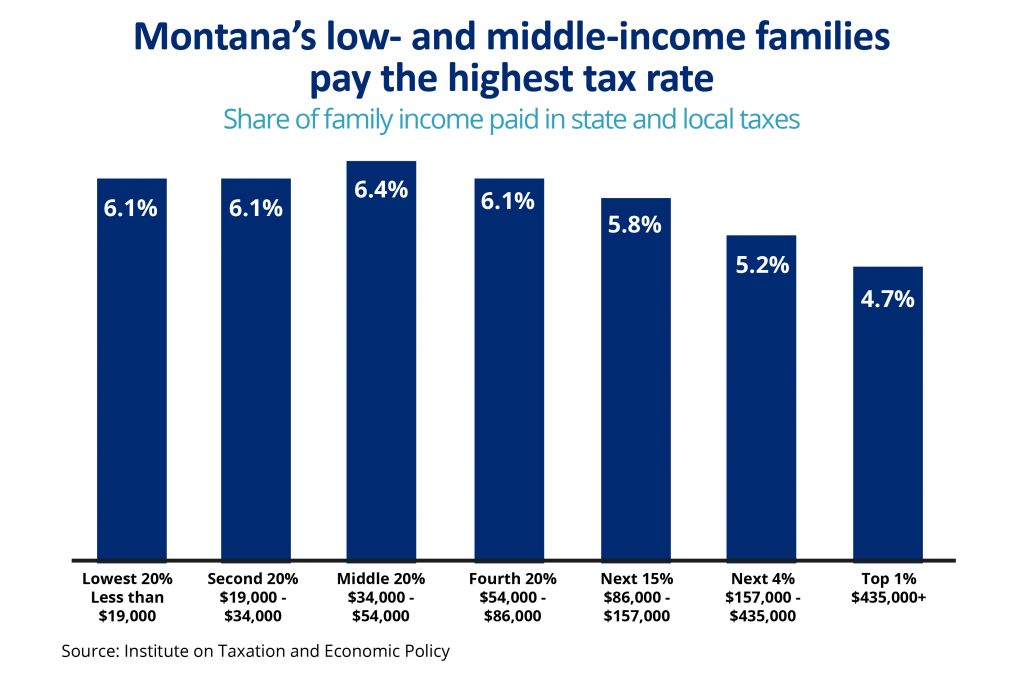

Nearly every state in the nation takes a greater share of income for taxes from low- and middle-income families than from the wealthiest households. A tax system is considered regressive when lower-income households pay a larger portion of their income in taxes compared to those households with higher incomes.

States that rely heavily on sales or consumption taxes have a more regressive tax structure. In the top ten states with the most regressive tax system, the lowest 20 percent of taxpayers pay seven times as much as a share of their income in taxes as the wealthiest 1 percent.[2] Six of the ten states with the most regressive tax structures rely on sales and excise taxes for roughly half to two-thirds of all tax revenue.[3]

While Montana ranks as one of the least regressive tax systems, lower-income families still pay a greater share of their income in state and local taxes than higher-income households. While the top 1 percent of households pay 4.7 percent of their income in taxes, the bottom 20 percent pay 6.1 percent, a thirty percent higher rate.[4] Part of the reason that Montana’s tax system is less regressive than surrounding states is that Montana has a progressive income tax (although less so after 2003, see below) and does not rely heavily on consumption taxes.

Sales Taxes Hurt Lower- and Middle-Income Families

Implementing a statewide sales tax would disproportionately hurt low- and middle-income families, particularly when compared with other revenue proposals such as a top income tax bracket on high-income earners or changes to the capital gains tax credit. Sales and excise taxes are the most regressive form of taxes. Low-income families pay almost eight times more of their income in these taxes than wealthy families, and middle-income families pay five times more.[5] State rates for sales tax range from 2.9 percent in Colorado to 6.85 percent in Nevada.[6] The average state’s consumption tax structure taxes the lowest-income families at a 7 percent rate, compared to 4.7 percent for middle income, and just 0.8 percent for the wealthiest households.[7]

While some states have attempted to mitigate the harm of sales taxes on lower-income families, sales and excise taxes – by definition – disproportionately impact lower-income households. Most states provide some sort of exemption or reduction of rate for food and/or prescription drugs and sixteen states have an exception for nonprescription drugs.[8] Even with an exemption or reduction of the rate for food and prescription drugs, a sales tax still impacts many products that low-income families need like school supplies, winter coats, and shoes. A sales tax could put purchasing a car necessary for work out of reach or exacerbate an already out of control housing market for low-income families.

Replacing Income or Property Tax with a Sales Tax is Both Impractical and Unfair for Montana Families

Policymakers often raise the idea of implementing a statewide sales tax as a replacement for the state individual income tax or state property tax, two of the largest streams of revenue that are less regressive than a sales tax.[9] As seen in past proposals, a statewide sales tax, set at the constitutional capped amount of four percent, with the elimination of either income or property tax, would result in a significant net loss of revenue.[10] Proposals in the 2017 legislative session would have resulted in a net loss in general fund revenue of over $300 million per year.

Furthermore, this policy change would make Montana’s tax code less fair. Replacing a less regressive tax with a more regressive one will continue to hurt low-income families already struggling to afford every day expenses.

Montana Already Imposes Several, More Targeted Excise Taxes

In Montana, we have a few already established excise taxes or local sales taxes, targeted at certain goods or services.[11] The state often uses this revenue to pay for services related to the goods sold. For example, a portion of cigarette tax revenue goes toward smoking cessation programs.

Below is the list of state and local excise taxes in Montana:

Expanding Excises Taxes Is Not a Long-Term Solution

In addition to being the most regressive tax, excise taxes are often insufficient revenue-raising tools, because they decline in value over time. Excise taxes are usually set at a per-unit basis, rather than a percentage of value, so the revenue generated by the tax is eroded over time.[15] Rates must continually be increased to keep pace with inflation. Using excise taxes to close fiscal gaps means balancing state budgets on the back of taxpayers who are the least able to pay, and these revenues represent a short-term fix rather than a long-term solution.

Local Option Sales Would Worsen Inequity among Montana Communities

In Montana, there are ten communities that have put in place a local “resort” tax.[16] In order to impose such a tax, a community must have a population of less than 5,500 for an incorporated town (or 2,500 for unincorporated area) and a major portion of its economy based on tourism. Once the Montana Department of Commerce certifies an area qualifies as a resort, the local voters must affirmatively vote on the tax rate, duration, effective date, and allocation of the revenue on a ballot initiative. A portion of the revenue must go toward property tax mitigation. The resort tax applies to a narrow list of goods and services targeted at tourists, including accommodations, restaurants, bars, and ski resorts or other destination recreational facilities.[17]

A recent proposal to allow other non-resort communities to extend a local option sales tax would disproportionately hurt low-income families and put many rural, struggling communities at an even greater disadvantage. Unlike statewide sales tax options that allow a state to implement targeted assistance to low-income families, a local option sales tax provides no effective mechanism to mitigate the harm on low-income families.[18] With the exception of a handful of Montana’s largest urban communities, the vast majority of Montana communities are unlikely to benefit from this option. As we have learned from local mills and bonds, some communities cannot or will not impose local taxes. This would continue to draw a deeper divide between communities of means and communities without.

Focus on Online Sales and “the Changing Economy” Is a Distraction and Faces Constitutional Hurdles

Recently, legislators have raised the issue that Montana should find a way to tax online sales, such as Amazon; however, this idea, by itself, is unrealistic and likely a way to push for a statewide sales tax.[19] Under federal law, states are prohibited from imposing a tax on a company that does not have a “substantial nexus” to the state. The Supreme Court ruled in 1992 that a state could not tax out-of-state mail order sales when that company does not have a physical presence in the state (i.e., property or employees).[20]

While the United States Supreme Court may consider overturning its current precedent and allow states to tax online sales, Montana still faces limitations on its ability to tax online sales, because we do not have a statewide sales tax.[21] Montana would likely face constitutional challenges in treating online companies differently than companies with an in-state presence.[22] Unfortunately, there are constitutional hurdles to imposing such a law without enacting a statewide sales tax.

Montana Can Make Its Tax Code Fairer and Raise Needed Revenue

Instead of taxing everyone, including our friends and neighbors with the least ability to pay, Montana should consider a variety of tax fairness measures that will bring in much needed new revenue, but also impact fewer people.

Unfortunately, Montana had a much more progressive tax system before 2003 when the legislature collapsed the tax brackets and lowered the rates for the wealthiest.[23] In 2003, the legislature reduced individual income taxes, which largely benefited wealthiest households. This law reduced the number of tax brackets, from ten to six, and lowered the top tax rate from 11 percent to 6.9 percent. Today, Montana workers making just a little over minimum wage ($17,900) pay the same top tax rate as someone with income over $1 million.[24]

Furthermore, Montana also taxes dividends and income from the sale of stock at a lower rate than income earned from wages. Montana is one of only nine states that provides a lower tax rate on capital gains.[25] This tax break largely benefits the super wealthy and costs our state over $30 million in lost revenue every year.[26]

Montana can right these wrongs, by:

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.